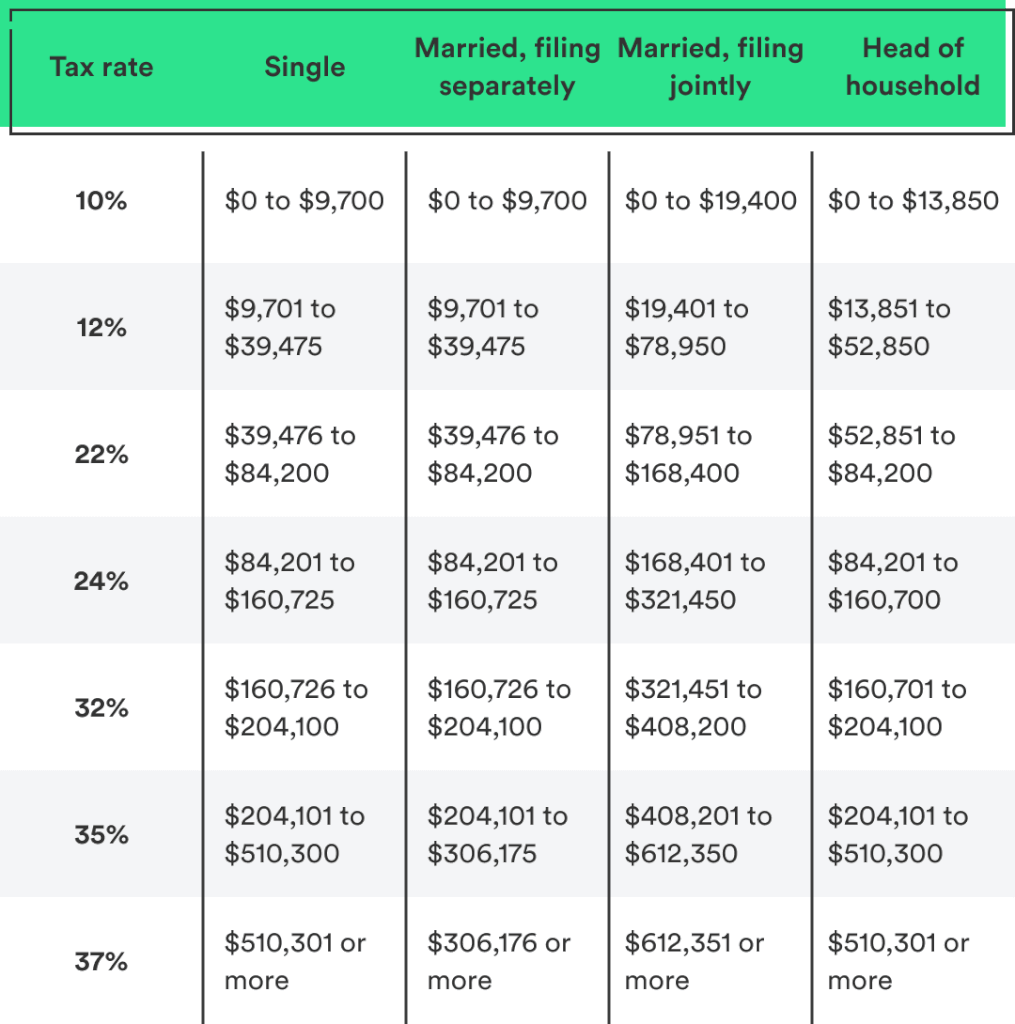

Federal Tax Brackets For 2025 Married Filing Jointly. For married people filing jointly, the top rate kicks in at $693,750 in income. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Filing 2025 Usa Latest News Update, Every bracket has its own tax rate. Want to estimate your tax refund?

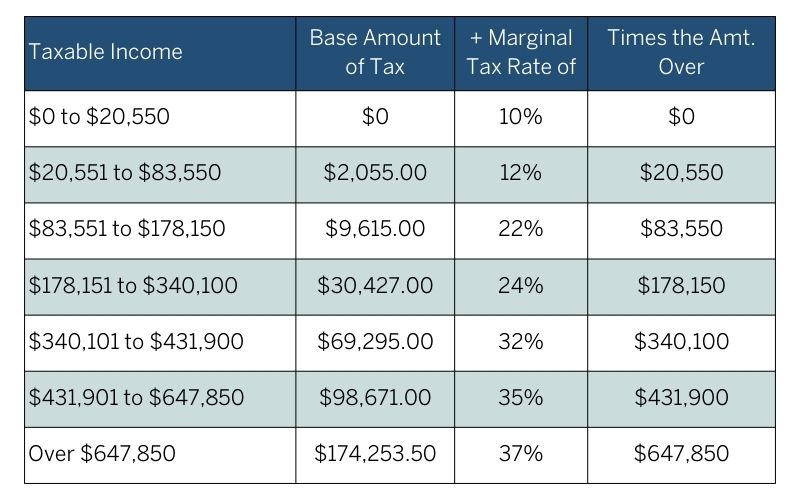

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 2025 tax brackets married filing jointly. There are seven tax brackets for most ordinary income for the 2025 tax year:

What Is My Tax Bracket 2025 Blue Chip Partners, Your bracket depends on your taxable income and filing status. For married people filing jointly, it rose to $27,700, up $1,800;

Irs Tax Brackets 2025 Married Filing Jointly Ambur Bettine, When deciding how to file your federal income tax return as a married couple, you have two filing status options: Updated on december 16, 2025.

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, Federal — married filing jointly tax brackets. For 2025, the deduction is worth:

What are the Different IRS Tax Brackets? Check City, Here’s how that works for a single person earning $58,000 per year: The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%,.

brackets reveal your tax rate as deadline to file 2025 taxes is, Edited by patrick villanova, cepf®. Estimate your 2025 taxable income (for taxes filed in 2025) with our tax bracket calculator.

Tax Changes for 2025 What You Need to Know Guiding Wealth, Use tab to go to the next focusable element. For married people filing jointly, the top rate kicks in at $693,750 in income.

20242024 Tax Calculator Teena Genvieve, The highest earners fall into the 37% range, while those who earn the least. For 2025, the deduction is worth:

IRS Tax Brackets AND Standard Deductions Increased for 2025, Estimate your 2025 taxable income (for taxes filed in 2025) with our tax bracket calculator. 2025 tax rates for other filers.